For example, during seasonal peaks in demand, when the FIFO principle may be challenged, having strong communication with suppliers can help ensure timely deliveries and adherence to the FIFO method. Again, you fulfill the order using the oldest pencils in the warehouse, which are from the first shipment. You now have 200 pencils remaining from the first shipment and 500 pencils from the second shipment in the warehouse. According to the FIFO system, you will sell the oldest pencils first, so you fulfill the order using the pencils from the first shipment that you purchased for $0.50 each.

How Does the FIFO Method Work?

Since the cost of goods sold is calculated using the oldest inventory, businesses can be sure that the costs reported to the tax authorities reflect their actual expenses. This also enables businesses to accurately predict their costs and income. This may mean they have a higher tax liability during the period in which they use FIFO, but it also means that their taxes will be accurately reported and paid. This helps to prevent overstating or understating income, which can have serious legal implications.

What is an example of FIFO in real life?

Many business require obsolete inventory to be written off against its bottom line after a predetermined period of time has lapsed since its last usage. FIFO helps prevent obsolete inventory by using the inventory first received before using newer inventory. The FIFO inventory method refers to the timing at which inventory is purchased and subsequently used. Inventory that is purchased first is sold or used in production before inventory that is purchased at a later date. In addition, there are other factors to consider when deciding between FIFO and LIFO.

Allows businesses to respond quickly to changes in customer demand

FIFO, or First In, Fast Out, is a common inventory valuation method that assumes the products purchased first are the first ones sold. This calculation method typically results in a higher net income being recorded for the business. The FIFO method is the first in, first out way of dealing with and assigning value to inventory. It is simple—the products or assets that were produced or acquired first are sold or used first.

The median (i.e., half of the parts were faster than this) was 36.1 time units for FIFO, and only 15.1 time units for LIFO. You can also see this on the bars, where the blue LIFO bars are much more toward the left than the green FIFO bars. I tell you that FIFO is so much better than LIFO, and yet this graph seems to indicate that LIFO is actually faster.

Improved Inventory Quality

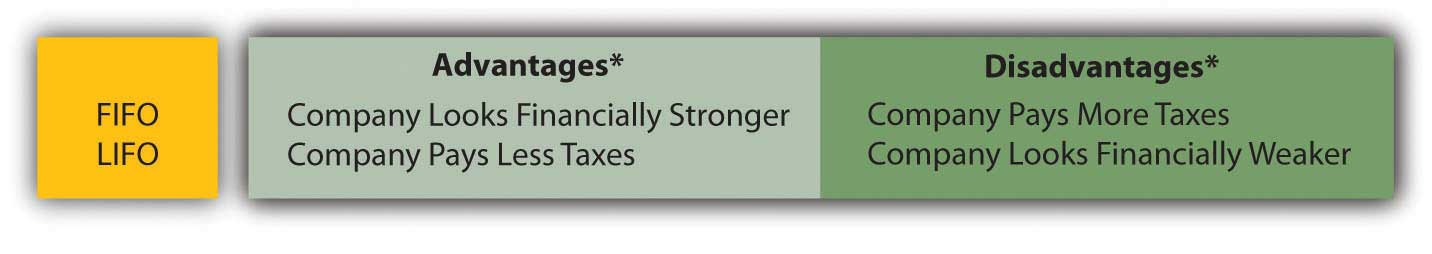

FIFO can lead to an improved inventory turnover rate, as it encourages the movement of older stock first. This reduces the likelihood of inventory sitting idle, tying up capital, and incurring holding costs. A higher turnover rate is often viewed positively by investors and creditors, as it indicates efficient inventory management and a higher rate of sales. The FIFO method can result in higher income taxes for a company because there’s a wider gap between costs and revenue. The alternate method of LIFO allows companies to list their most recent costs first in jurisdictions that allow it.

- Product quality is upheld while also complying with health and safety standards.

- Conducting regular inventory audits is vital, and involves conducting periodic audits to ensure the accuracy of inventory records.

- Forge strong relationships with your suppliers to ensure their cooperation in adhering to FIFO principles.

- FIFO is calculated by adding the cost of the earliest inventory items sold.

- But in some countries, only one inventory valuation strategy is permitted by law.

It can also refer to the method of inventory flow within your warehouse or retail store, and each is used hand in hand to manage your inventory. The FIFO method is especially critical for pharmaceutical companies dealing with drugs and medications. To comply with regulatory requirements and ensure patient safety, pharmaceutical manufacturers and distributors need to prioritize the sale of drugs based on their expiration dates. The FIFO method helps avoid stockpiling expired products, reduces wastage, and ensures patients receive medicines with the maximum potency. To calculate the FIFO value of inventory and COGS, businesses need to take the cost of the oldest items in inventory and divide it by the total number of units purchased.

But FIFO has to do with how the cost of that merchandise is calculated, with the older costs being applied before the newer. This is often different due to inflation, which causes more recent inventory typically to cost more than older inventory. While FIFO is a popular and effective method for the management and valuation of inventory, it is not the only option available. where’s my refund how to track your tax refund status Let’s discuss some of the other methods for valuing inventory and how they compare to FIFO. Additionally, LIFO’s reception varies globally, with some accounting standards discouraging its use, thereby limiting its applicability for international businesses. FIFO may help contribute to higher ending inventory balances on the balance sheet, but LIFO does the opposite.